Facing the possibility of losing your home can be one of the most stressful and overwhelming experiences a homeowner can go through.

Unfortunately, foreclosure is a reality for many Texas residents, but it doesn’t have to be a certainty. There are steps you can take to stop a foreclosure and potentially save your home.

To learn more about how to stop foreclosure in Texas, continue reading.

Understanding Foreclosure in Texas

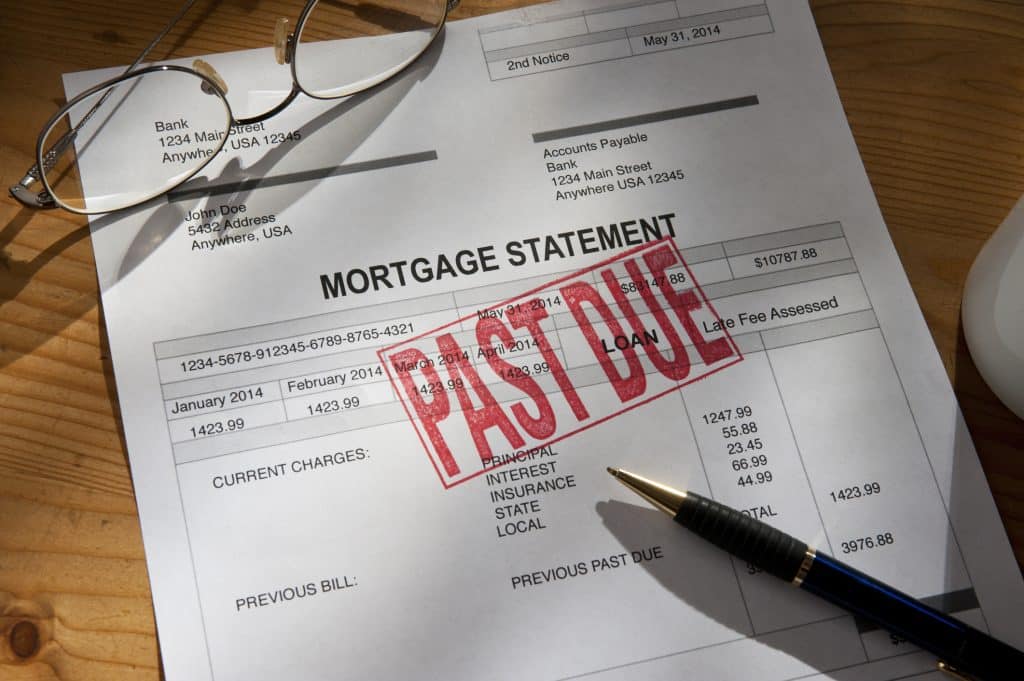

Foreclosure in Texas is the legal process where a lender repossesses a property due to non-payment, and an understanding of this process can help homeowners navigate through potential solutions.

Receive a Fair & FREE No Pressure Cash Offer

Definition of foreclosure

Foreclosure happens when a homeowner fails to pay their mortgage. The lender then takes legal steps to take back the property. This process allows the lender to recover part or all of the amount owed by selling or taking possession of the property.

In Texas, foreclosure laws set specific rules on how and when this can happen. Homeowners receive notices before losing their homes.

They have options like bankruptcy, loan modification, and counseling to stop foreclosure.

Seeking help early can make a big difference in keeping your home.

Process of foreclosure in Texas

In Texas, the foreclosure process starts when a homeowner fails to make mortgage payments. The lender then sends a notice of default, giving the homeowner a chance to catch up on missed payments.

If payments are not made, the lender can file a notice of sale. This notice must be posted at least 21 days before the property is sold at auction.

At the auction, buyers bid on the property. If it gets sold, the new owner can ask for an eviction if needed. Homeowners have until the day of sale to pay off their debt and stop foreclosure.

They can also seek solutions like loan modifications or file for bankruptcy as ways to halt this process.

Options for Avoiding Foreclosure

Explore bankruptcy, loan modification, and foreclosure intervention counseling as potential strategies to halt foreclosure in Texas.

To learn more about these options and find the best course of action for your situation, keep reading.

Bankruptcy

Filing for bankruptcy can stop foreclosure proceedings in Texas. Chapter 13 filings enable an automatic stay to halt the process once the lender is notified.

Seeking guidance from a skilled Texas bankruptcy attorney is essential, as they can provide legal options and help navigate through the complexities of the situation.

Homeowners should take proactive steps and understand their available options, such as bankruptcy, loan modification, and counseling services to protect their property from foreclosure.

Loan modification

Seeking a loan modification can be a viable option for Texas homeowners facing foreclosure. This involves negotiating with the lender to change the terms of the existing loan, such as reducing the interest rate or extending the repayment period.

This could help make mortgage payments more manageable and prevent foreclosure in Texas.

Additionally, speaking to an experienced Texas bankruptcy attorney can provide guidance on navigating through this process and exploring all available options for stopping foreclosure.

Receive a Fair & FREE No Pressure Cash Offer

Foreclosure intervention counseling

Foreclosure intervention counseling provides guidance and support to Texas homeowners facing the threat of foreclosure.

By seeking assistance from HUD-approved counseling organizations, homeowners in San Antonio can access tailored advice on navigating the complexities of the foreclosure process.

These housing counseling agencies offer not only comprehensive information but also practical strategies to help homeowners prevent foreclosure and protect their properties.

Understanding available resources such as hotlines for foreclosure prevention and HUD-approved intervention programs is crucial for Texas homeowners who are endeavoring to stop foreclosure proceedings.

Steps to Take to Stop a Foreclosure in Texas

To stop foreclosure in Texas, read all mail from creditors and tax offices carefully. Talk to a Texas debt lawyer to understand your rights and options.

Read all mail from creditors and tax offices

When you receive mail from creditors and tax offices, open and read it promptly. Creditors may send important information about your mortgage or payments, while tax offices could provide details about property taxes.

It’s crucial not to ignore these communications as they may include vital notices regarding foreclosure proceedings or other actions.

Stay informed by carefully reviewing all correspondence to understand your current financial situation and take necessary steps to prevent potential issues.

Talk to a Texas debt lawyer

Consider speaking with a Texas debt lawyer to explore legal options for stopping foreclosure.

Engaging a skilled attorney can provide guidance on steps such as bankruptcy filings and obtaining restraining orders to halt the foreclosure process.

Decide if you want to keep your home

Consider your desire to keep your home. Seek advice from a Texas debt lawyer and explore options like bankruptcy. Take proactive steps to protect your property in Texas.

The HUD website provides resources for homeowners facing foreclosure, including a toll-free hotline and a search tool for counseling organizations.

Receive a Fair & FREE No Pressure Cash Offer

Consider declaring bankruptcy

Declaring bankruptcy in Texas is one option to stop foreclosure proceedings. Chapter 13 filings allow for an automatic stay and can halt the foreclosure process once the lender is notified.

Seeking guidance from a skilled Texas bankruptcy attorney can provide clear options and help homeowners navigate this complex situation.

It is important to take proactive steps and consider all available legal avenues to prevent foreclosure and protect your property.

Beware of Scams and Seek Professional Help

Watch out for fraudulent offers and always seek assistance from certified housing counselors or foreclosure attorneys.

Be cautious of fraudulent offers

Beware of deceptive offers that claim to stop foreclosure with unrealistic promises. Some scammers may try to take advantage of vulnerable homeowners facing foreclosure in Texas, offering false hopes and charging hefty fees for their services.

Stay vigilant and seek assistance from certified housing counselors or foreclosure attorneys to protect yourself from falling victim to fraudulent schemes.

It is crucial for homeowners in San Antonio to be wary of scams promising quick fixes and guaranteed results when dealing with foreclosure.

Protect your best interests by verifying the legitimacy of any offers before engaging with them, as falling for fraudulent schemes can worsen the situation.

Receive a Fair & FREE No Pressure Cash Offer

Seek assistance from a certified housing counselor – Contact a foreclosure attorney

Get help from a reputable housing counselor who is certified to provide foreclosure intervention counseling in Texas.

These professionals can guide you through the available options and help you navigate the complexities of preventing foreclosure, including loan modifications and payment plans.

Additionally, consider reaching out to a skilled foreclosure attorney in Texas who can offer legal advice tailored specifically towards your situation.

They can assist with exploring legal avenues such as filing for bankruptcy or obtaining restraining orders to halt the foreclosure process.

Additional Resources for Homeowners

Explore the available resources and assistance for homeowners in San Antonio. Check out more details on our website.

Hotline for foreclosure prevention

Facing foreclosure in Texas? Help is just a call away. The HUD provides a toll-free hotline where Texas homeowners can seek guidance and support to prevent foreclosure.

This hotline connects you with housing counseling agencies and HUD-approved foreclosure intervention counseling organizations, offering crucial assistance in navigating the complexities of stopping foreclosure.

Don’t hesitate; reach out for help today.

Additional Real Estate Advice:

- Working With A Realtor To Sell Your House in San Antonio

- Tips For Selling Your House For Cash Quickly

- is Selling Your House as is a Good Idea

- How To Sell My House Fast For Cash in San Antonio

- is Now a Good Time to Sell a House

- Can You Sell a House With Termite Damage

- Moving Out of State Should I Rent or Sell My House

- is FSBO a Good Idea

- Can My Husband Sell Our Home Without Me

- Can You Sell a Property With a Lis Pendens

- Why Can’t I Sell My House

- Why is a Cash Offer Better When Selling a House

- Pros and Cons of Selling a House as is

- Can I Sell My House While in Foreclosure

- What is a Subject To Mortgage in Real Estate

Receive a Fair & FREE No Pressure Cash Offer

- is it Illegal to Sell a House With Termites

- If I Sell My House Will I Lose My Food Stamps

- Sell House For Cash Pros and Cons

- is Selling Your Home by Yourself a Good Idea

- is it Better To Sell Your Home For Cash

- is Selling Your Own Home Worth it

- The Benefits of Selling a House Fast For Cash in San Antonio

- Can I Sell My House To My Friend Without a Realtor

- Why isn’t My Home Selling Faster

- When Should You Sell Your Home as is

- How Many Missed Payments Before Foreclosure

- Is Selling Your Home and Renting a Good Idea

- is it a Good Idea to Sell My House Now

- is it Safe To Sell Your Home For Cash

- How To Sell My Mobile Home Fast For Cash

- Can You Sell a House As Is Without Inspection

- is Selling Your House a Capital Gain

Housing counseling agencies

Housing counseling agencies in Texas offer guidance and support to homeowners facing foreclosure. These agencies can provide resources and assistance tailored to Texas foreclosure laws.

By seeking help from HUD-approved counseling organizations, homeowners can access hotlines and programs designed to prevent foreclosure.

It’s essential for San Antonio homeowners to reach out for professional help when navigating the complex realm of foreclosure prevention.

It is crucial for Texas homeowners in San Antonio to seek assistance from housing counseling agencies as they navigate the complex process of preventing a foreclosure on their property.

HUD-approved foreclosure intervention counseling organizations

HUD-approved foreclosure intervention counseling organizations offer assistance to Texas homeowners facing foreclosure. These organizations provide guidance and support in navigating the complexities of foreclosure prevention.

They are equipped with the resources and expertise to help homeowners understand their options, including loan modification and other alternatives to stop foreclosure.

By seeking help from these certified housing counselors, Texas homeowners can access valuable resources such as hotlines for foreclosure prevention and tailored assistance programs.

It’s important for San Antonio residents dealing with the threat of foreclosure to reach out to these HUD-approved counseling organizations for expert advice and support.

Resources For Selling Your Home as-is:

- Need To Sell My Home Fast Pros & Cons

- How Much Does it Cost To Sell a House in Texas

- Can I Sell My Parents Home With a Power of Attorney

- Can You Sell a House With Mold in Texas

- Can I Sell My Home If I’m in Foreclosure

- Can You Sell Your Home With Code Violations in Texas

- Can I Sell My Home and Still Live it Rent-Free

- Can You Sell a House With a Mortgage

- Top Reasons To Sell Your House Fast

- The Secret To a Fast Sale of a Property

- Should I Sell My House Subject To

- Can I Sell My Deceased Parents’ House Without Probate

- How To Sell Your House Fast Without a Realtor

Receive a Fair & FREE No Pressure Cash Offer

- Can You Sell a House With Unpaid Property Taxes

- Alternative Ways To Sell A House Quickly

- Can You Sell a Condemned House

- Can You Sell a House Before Probate

- After Someone Dies How Long Do You Have To Sell

- How Soon After Chapter 7 Bankruptcy Can I Sell My House

- Top 10 Ways To Sell Your Home Quickly

- Can I Sell My House If I Have a HELOC Loan

- Can You Sell Your House Without My Spouse’s Signature

- is Selling Your Home To a Real Estate Investor a Good Idea

- Is It a Good Time to Sell My House Now

- How To Sell a House That’s in Foreclosure

- I Want To Sell My Home Where Do I Start

- Can Someone Take Over My Mortgage Payments

- What is The Best Month To Sell a Home

- Who Buys Houses For Cash Near Me

- Paperwork For Selling a House Without a Realtor

- I Lost My Job Should I Sell My House

- Can I Refuse To Sell My House To an Investor

Foreclosure assistance programs

Explore available foreclosure assistance programs in Texas for San Antonio homeowners. HUD-approved counseling agencies offer guidance and resources to help prevent foreclosure.

Homeowners can reach out to housing counselors who provide tailored solutions, including payment plans, forbearances, and loan modifications.

The hotline for foreclosure prevention is a valuable resource, offering support during the ever-evolving process of preventing or stopping foreclosure.

Seek professional assistance from certified counselors or a skilled attorney to navigate the complexities of halting foreclosure in Texas.

Wrapping Up

Stop foreclosure in Texas by taking proactive steps like reading all mail from creditors, consulting a debt lawyer, and considering bankruptcy.

Seek assistance from certified housing counselors and foreclosure attorneys to avoid scams.

Additional resources include hotlines for prevention and HUD-approved counseling organizations.

Implement these practical strategies to protect your property in Texas and secure a better financial future.

FAQs about how to stop a foreclosure

1. What are some ways to stop a foreclosure in Texas?

You can halt a foreclosure by talking to your lender about options like loan modification, seeking help from foreclosure prevention programs, or using legal ways such as hiring a foreclosure defense attorney in Texas.

2. Can I get assistance to avoid foreclosure in Texas?

Yes, there are resources and assistance for avoiding foreclosure available, including the foreclosure prevention hotline in Texas and various stop foreclosure assistance programs designed to help homeowners.

3. How does the foreclosure process work in Texas?

The Texas foreclosure timeline starts with default and notice before moving to the stage of a possible auction. Foreclosure mediation might be an option before the final sale.

4. Are there steps I can take early on to prevent going into default and facing a potential home loss?

To prevent going into default and eventual loss of your home, consider exploring all available options early on such as refinancing your mortgage or seeking advice from agencies that offer tips for preventing foreclosures in Texas.

5. Is there a way to temporarily stop my house from being sold at a foreclosure auction in Texas?

In certain situations, you may be able to delay or stop your house from being sold at auction through methods like filing for bankruptcy which enacts an automatic stay or requesting a temporary moratorium if applicable under state law.

We Pay Cash For Houses in San Antonio Regardless of Condition, Location, or Price!

Get a cash offer for your San Antonio home by filling out the short online form below.

Our team of savvy real estate problem-solvers is here to guide you through our fast home selling process and give you a fair offer on your home!