Are you a homeowner in San Antonio, TX, pondering whether to sell your house subject-to? You’re not alone. The thought of passing on the obligation of an existing mortgage to a buyer may seem complex or even risky.

However, it could also be a strategic move that benefits you and helps navigate through financial hurdles or market fluctuations. In San Antonio’s dynamic real estate landscape, where commissions can significantly affect your final take-home from a sale, innovative selling options might just be the answer.

A fact worth noting is that homes sold between March and July tend to fetch higher prices and sell more quickly in this city—a crucial consideration for those looking to maximize their profits.

This article aims to guide you through the ins and outs of selling your house subject-to in San Antonio. We’ll unpack what it means for both seller and buyer while weighing up the potential advantages against possible risks.

Get ready to discover if this method fits your home-selling goals!

Quick Summary

- Deciding to sell your house “Subject To” in San Antonio depends on your financial goals and the terms of the existing mortgage. Evaluate the potential benefits against the risks and consult with a real estate professional for personalized advice based on your specific circumstances.

- Selling a house “subject – to” in San Antonio means the buyer takes over the existing mortgage payments without assuming the loan, benefiting both parties involved.

- Benefits for sellers include improvement in credit score, debt relief, retained property value, avoiding foreclosure, and ability to purchase another home while transferring their existing mortgage.

- Sellers can potentially earn more value from the sale by negotiating a higher selling price and favorable terms with potential buyers through this method.

- However, risks of selling subject 2 include remaining responsible for the mortgage if the buyer fails to make payments and potential triggers of due-on-sale clauses in mortgages.

What Does it Mean to Sell a House “Subject-To”?

Selling a house “subject-to” means that the buyer will take over the existing mortgage payments without actually assuming the loan. This allows the seller to transfer ownership of the property while still being responsible for the mortgage, providing benefits for both parties involved in the transaction.

Definition and process

A “subject-to” home sale means the buyer takes over the mortgage payments of the seller’s existing loan. The loan stays in the seller’s name, but the buyer owns the home and makes all future payments.

This process can be quick because it skips getting a new loan.

First, both sides agree on a price and terms. Next, they sign a contract that says the buyer will pay off the remaining debt on time. The house changes hands without paying off the current mortgage right away.

The original lender keeps expecting payments just like before, even though there is a new owner now.

Benefits for both buyer and seller

When considering the process of selling a house “subject-to,” it’s essential to understand the benefits for both the buyer and the seller. Here are some key advantages for both parties:

- Improvement in Credit Score: Selling subject-to allows sellers to relieve themselves of mortgage responsibility without impacting their credit negatively.

- Debt Relief: Sellers can instantly free themselves from mortgage debt, providing financial relief.

- Retained Property Value: Sellers can retain more value from the sale compared to a potential foreclosure.

- Avoiding Foreclosure: Selling subject-to offers an opportunity to avoid foreclosure and its long-term impact on credit.

- Full Loan Transparency: Buyers gain insight into existing loan terms, allowing them to make informed decisions.

- Ability to Purchase Another Home: Sellers can still qualify for another home purchase while transferring their existing mortgage.

Differences from traditional selling methods

When considering selling a house subject-to in San Antonio, it’s essential to understand the differences from traditional selling methods. Here are some key points to consider:

- Traditional selling involves paying off the existing mortgage before transferring ownership, while selling subject-to allows the buyer to take over the existing mortgage.

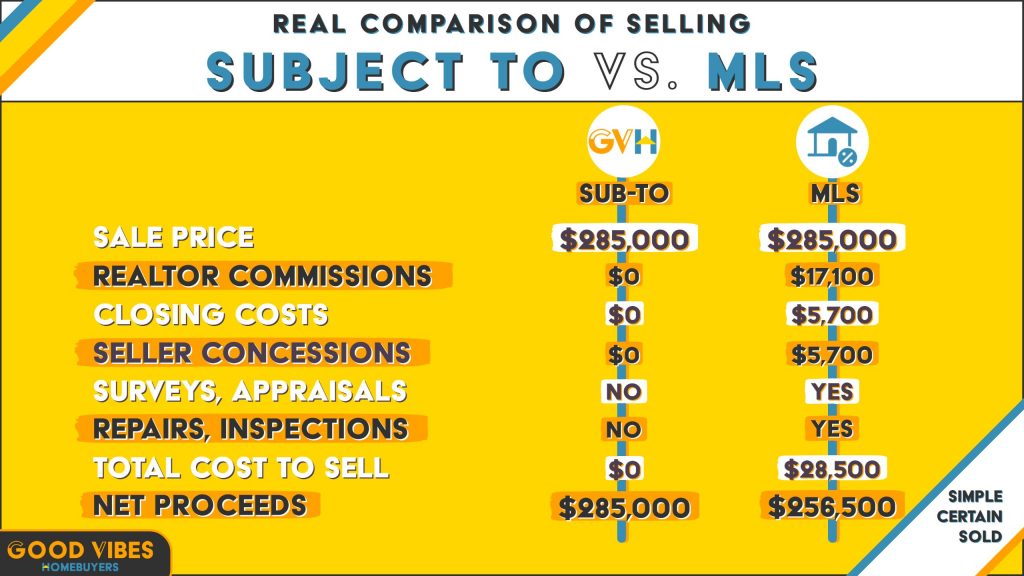

- Subject-to transactions often bypass real estate agents and their associated fees, providing a more cost-effective option for both parties.

- With traditional selling, sellers may need to make repairs or renovations to attract buyers, whereas subject-to sales allow the property to be purchased as-is.

- Unlike traditional selling that follows a standard closing process, subject-to sales require careful consideration of existing mortgage terms and potential risks.

- Traditional selling typically involves a longer timeline due to various processes and negotiations, whereas subject-to transactions can offer a quicker and smoother transfer of ownership.

Advantages of Selling a House “Subject 2”

– Save and improve credit: By selling your house “subject-to,” you can avoid missing mortgage payments and protect your credit score. This can be especially beneficial if you’re in financial hardship.

Save and improve credit

When you sell your house “subject-to” in San Antonio, you can save and improve your credit. By transferring the mortgage to the buyer, they take over payments, giving you relief from debt while still maintaining a positive payment history.

This method can prevent foreclosure and boost your credit score as the mortgage is paid on time. Plus, it allows you to move forward with purchasing another home without affecting your credit negatively.

Next up is how selling subject-to provides instant debt relief for San Antonio homeowners.

Get instant debt relief

By selling your house “subject-to” in San Antonio, Texas, you can get instant debt relief. When you sell subject-to, the existing mortgage stays in place, and the buyer takes over payments.

This means you are relieved of the burden of making mortgage payments on a property you no longer want or need. By transferring this financial responsibility to the buyer, you can immediately lighten your debt load and alleviate financial strain.

Selling a house subject-to offers homeowners in San Antonio TX an immediate way to offload their current mortgage obligation and gain much-needed relief from debt. This method allows for an expedited resolution to a pressing financial issue without having to wait for long-term processes like foreclosure proceedings or traditional home sales, enabling sellers to quickly regain control over their finances.

Earn more value from house sale

When selling a house subject-to in San Antonio, homeowners can potentially earn more value from the sale. This method allows sellers to negotiate a higher selling price and favorable terms with potential buyers, increasing the overall profit from the transaction.

Additionally, by offering flexible financing options and assuming the existing mortgage, sellers may attract more buyers who are willing to pay a premium for such convenience. Leveraging this approach enables homeowners to maximize their property’s value while securing a beneficial deal that suits both parties involved.

By utilizing this strategy, San Antonio Texas homeowners can strategically position themselves to earn more value from their house sale without compromising on profitability or market competitiveness.

Avoid foreclosure

To avoid foreclosure in San Antonio, Texas, selling a house “subject-to” can provide a lifeline. This approach allows you to transfer the property to a buyer who takes over your existing mortgage payments, relieving you of the financial burden and preventing foreclosure proceedings.

By considering this option, homeowners facing potential foreclosure can protect their credit score and maintain ownership of their home while staying current on mortgage payments.

Through selling “subject-to,” homeowners have an opportunity to find a solution that prevents them from losing their homes due to financial hardship or other circumstances. This alternative allows for greater flexibility while ensuring that homeowners are not forced into foreclosure proceedings if they encounter difficulties in meeting mortgage obligations during tough times in the real estate market.

Full loan transparency

When considering selling a house “subject-to” in San Antonio, full loan transparency is vital. Understanding the existing mortgage and debts on the property allows for informed negotiations with the seller.

This ensures clarity regarding the financial obligations being undertaken and helps in making well-informed decisions about the transaction.

To avoid any potential surprises or misunderstandings, it’s essential to have a clear understanding of all aspects of the existing loan and debts tied to the property when selling subject-to in San Antonio.

Still able to purchase another home

Even after selling your house subject to the existing mortgage, you can still purchase another home in San Antonio, TX. This option allows you to move forward with a new home purchase while the buyer takes over your existing mortgage and debts.

By doing so, you have the flexibility to explore other housing opportunities without being tied down by your previous property obligations.

Selling your house subject-to not only relieves you of financial burdens but also keeps open the possibility of investing in a new property. This means that you can transition smoothly from one homeownership situation to another without having to wait for long periods or face potential hurdles when seeking out a new residence in San Antonio, Texas.

Risks and Considerations of Selling a House “Subject To”

Potential pitfalls and risks of selling with an existing mortgage, as well as what homes cannot be sold “subject-to,” will be discussed in this section. Learn more about the protection and handling of closing to make informed decisions about selling your house subject to in San Antonio TX.

Read on to find out more.

Potential pitfalls

Selling a house “subject-to” in San Antonio TX comes with potential pitfalls that homeowners and landlords should be aware of:

- Existing Mortgage: Selling subject-to means the existing mortgage remains, leading to the risk of default if the buyer fails to make payments.

- Property Condition: Sellers may find themselves responsible for repairs and maintenance costs after the sale, impacting their finances.

- Buyer Reliability: Dependence on the buyer’s ability to meet mortgage obligations can lead to uncertainty and financial strain.

- Legal Implications: Without proper legal guidance, sellers may face complications due to breaches or misunderstandings in the sales process.

- Equity Protection: The risk of losing equity in the property due to unforeseen circumstances beyond one’s control is a significant concern.

- Market Volatility: Fluctuations in the real estate market could affect the overall value and potential returns from selling subject-to.

Risks of selling with existing mortgage

When selling a house subject-to with an existing mortgage, there are several risks to consider. One major risk is that the original seller remains responsible for the mortgage even after transferring ownership to the buyer.

This means if the buyer fails to make payments, it could negatively impact the seller’s credit and financial stability. Additionally, in some cases, due-on-sale clauses in mortgages can be triggered by this type of transaction, leading to the immediate repayment of the loan balance.

It’s crucial to thoroughly understand these risks and seek legal advice before proceeding with this selling method.

Moreover, when considering selling a house subject-to in San Antonio TX, homeowners should also keep in mind that not all properties are eligible for this type of sale. Certain mortgages and properties may have restrictions or prohibitions against transfer of ownership without full repayment.

What homes cannot be sold “subject-to”?

Selling a house “subject-to” may not be possible for properties with due-on-sale clauses, also known as acceleration clauses. These are common in mortgages and allow the lender to demand full repayment when the property ownership changes.

Additionally, properties facing foreclosure proceedings or those with outstanding IRS tax liens cannot be sold subject-to. It’s important to understand these limitations before considering this selling method to maximize profits and avoid potential legal issues.

Protection and handling of closing

When finalizing a subject-to transaction, it’s crucial to ensure legal protection for both parties involved. Seek professional guidance and draw up a clear contract that outlines all terms and conditions to protect against potential disputes or misunderstandings.

Additionally, safeguard the existing mortgage by diligently handling the closing process to prevent any complications arising from the transfer of ownership, ensuring transparency and adherence to legal requirements throughout.

It’s vital to have full loan transparency when closing a subject-to deal in San Antonio. Legal considerations for selling such properties must be thoroughly understood as they involve complexities related to the existing mortgage and debts.

Legalities and eligibility in San Antonio TX

When selling a house “subject-to” in San Antonio, Texas, it is crucial to understand the legalities and eligibility. Ensure that you comply with all real estate transaction laws in Texas and consider any specific regulations related to selling property in San Antonio.

This includes understanding the due on sale clause and other legal considerations for selling a house subject-to. By staying informed about these legal aspects, you can protect your interests when engaging in this type of real estate transaction.

Additional Real Estate Advice:

- Working With A Realtor To Sell Your House in San Antonio

- Tips For Selling Your House For Cash Quickly

- How To Sell My House Fast For Cash in San Antonio

- The Benefits of Selling a House Fast For Cash in San Antonio

- Can I Sell My House To My Friend Without a Realtor

- How Much Does it Cost To Sell a House in Texas

- Can I Sell My Parents Home With a Power of Attorney

- Can You Sell a House With Mold in Texas

- Can You Sell Your Home With Code Violations in Texas

- Can I Sell My Home and Still Live it Rent-Free

- Can You Sell a House With a Mortgage

Duration and protection of existing mortgage

When selling a house subject-to in San Antonio, it’s crucial to consider the duration and protection of the existing mortgage. This means understanding how long the existing mortgage will remain in effect and what measures are in place to protect both the buyer and seller throughout the process.

Sellers should carefully review their mortgage terms to ensure compliance with selling subject-to, while buyers need to understand their obligations and protections under this arrangement.

Selling a house subject-to comes with unique considerations surrounding the duration of the existing mortgage and protective measures for both parties involved. In San Antonio, understanding these factors is essential for a smooth transaction that benefits both sellers and buyers alike.

Alternatives and negotiations with potential buyers

When considering alternatives and negotiations with potential buyers for selling a house subject-to in San Antonio TX, it’s important to keep the following points in mind:

- Explore alternative financing options such as lease options or seller financing to attract more potential buyers and maximize the selling price.

- Negotiate terms and conditions that work in your favor, such as a flexible closing date or adjustments to the existing mortgage terms.

- Consider offering incentives to potential buyers, such as covering closing costs or providing a home warranty, to make the deal more appealing.

- Highlight the benefits of buying subject – to, such as the opportunity to acquire a property without needing a traditional mortgage approval process.

- Be transparent about the existing mortgage and debts, providing comprehensive information and addressing any concerns potential buyers may have.

- Emphasize the advantages of subject – to transactions, including potential tax benefits and lower upfront costs for buyers compared to traditional purchasing methods.

- Work with experienced real estate professionals who can guide you through negotiations and help you assess different offers from potential buyers effectively.

Pros and cons of using “subject-to” method for selling

Selling a house using the “subject-to” method can be a strategic move for San Antonio homeowners and landlords. Here’s a look at the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Save on commissions, which typically run 5-6% of the home’s sale price. | Potential pitfalls if buyers default on existing mortgage payments. |

| Receive instant relief from mortgage debt, aiding financial stability. | Sellers risk remaining liable for the mortgage if buyers fail to make payments. |

| Possibility to earn more from the sale due to reduced selling costs. | Houses saddled with liens or in disrepair might not be eligible for “subject-to” sales. |

| Helps avoid foreclosure, protecting the seller’s credit score. | Requires a deep understanding of the existing mortgage to negotiate effectively. |

| Loan transparency, ensuring all parties understand the financial obligations. | Handling of closing must be thorough to protect both buyer and seller. |

| Sellers can purchase another home, as the mortgage doesn’t reflect as an active loan on their credit. | Limited control over the property once sold, including enforcement of loan payments. |

Given these factors, it’s clear the “subject-to” method offers unique opportunities and challenges for property sales. The next section will delve into frequently asked questions regarding selling a house “subject-to” in San Antonio.

In Conclusion

Selling your home subject to in San Antonio, TX can provide various benefits. This approach allows flexibility and can prevent foreclosure. Understanding the process and potential risks is crucial for a successful transaction.

Consider the impact on profits and commissions, while also maximizing timing within the real estate market in San Antonio. Take action with confidence and always seek professional guidance for a smooth selling experience.

Selling a House “Subject-To” FAQs

1. What does “Sell My House Subject To” mean in San Antonio, TX?

“Sell My House Subject To” means you’re selling your house in San Antonio with its existing mortgage to a buyer who will make payments on that mortgage.

2. Should I sell my home or rent it out in San Antonio?

Deciding whether to sell your home or rent it out depends on the housing market trends in San Antonio and if renting can cover your costs compared to the benefits of selling for cash.

3. What is the Seller’s Disclosure Notice when selling a house in Texas?

The Seller’s Disclosure Notice is a report you give buyers telling them about the condition of your property before they decide to buy it.

4. Can I sell my house off the MLS quickly in San Antonio?

Yes, selling off the MLS often helps owners sell their houses faster because it can reach investors looking to buy houses for cash without waiting for bank loans.

5. Are there pros and cons to buying a house subject to an existing mortgage?

Yes, one pro is that buying this way might let you get into a home with less upfront money; however, if interest rates rise or housing market reports show declines, this could be risky.

Do you need to sell your San Antonio home quickly, give us call at (210) 570-4984 or fill out the short online form.

Our team of savvy real estate problem-solvers is here to guide you through our fast home buying process and give you a fair offer on your home!